Out of eviction, 2020 is being hailed as a resurgence year for emerging-markets investing. In sub-Saharan Africa, the World Bank forecasts economic development to choose up to 2.9% (from an approximated 2.5% in 2019. But global investors enjoying signs like oil and product exports may be missing out on the real story, according to local and local impact investors.” There are numerous more financial investment opportunities in Africa than people will see from afar.

” What we discover most interesting are opportunities investors often misconstrue.” For instance? Financial inclusion, logistics and agriculture., with offices in Amsterdam, Nairobi and Cape Town, is raising a series of funds for its pan-African uMunthu impact effort. Goodwell has actually just recently invested in Nigeria’s, a bike taxi hailing and financing start-up, and South Africa’s, which designed a digital payments platform for informal company owners.

The surge of mobile money across the continent has actually produced facilities to support a raft of new services. In farming, unlocking the efficient capacities of almost countless smallholder farmers, he says, could sustain a “bottom-up agricultural transformation.” Efficient logistics has a ripple effect on every other sector, from health care delivery to education.

Other regional and regional investors concur small and growing businesses represent the biggest impact opportunities on the continent. “This sector of the marketplace is the support of the African economy,” Nigeria-based Aruwa Capital’s Adesuwa Okunbo Rhodes told ImpactAlpha. Buying these organisations’ development is impact investing, she argues.

The gender-focused impact financier is targeting West African people and family workplaces to raise its very first fund in order to show what’s possible “Fundraising from them was deliberate. Tysdal securities fraud theft. They comprehend the ecosystem and understand the companies in our pipeline,” Rhodes states. “We can take that portfolio and performance history to institutional investors.” A handful of high profile, big-ticket deals in 2015 put Africa back on the radar of global investors, and stirred issues about an Africa “bubble.” Medical drone delivery business Zipline scored a tremendous $190 million from TPG Development’s Rise Fund, Temasek, Goldman Sachs and others.

Off-grid solar business in Africa raised hundreds of countless dollars (investors state prosecutors). Digital monetary services business have actually set new records in both revenues and assessments. LeapFrog’s Andrew Kuper informed ImpactAlpha that JUMO’s $70 million capital raise, led by Goldman Sachs in December 2018, was the first indication of growing digital lending, followed by Tala’s $110 million Series D round last August.

Grant Carter Obtained

LeapFrog is an investor in both JUMO and WorldRemit. LeapFrog raised $700 million for its third fund last year on the strength of its tally of exits and successes in under-capitalized sectors of the African market. Kuper says access to fundamental services for 10s of countless people throughout the continent represents a major positive shift.

Kuper stated LeapFrog “sees outstanding deal flow continuing in consumer-led healthcare and financial services in 2020. carter agreed pay. He likewise expects to see more “buy-and-build offers,” such as Goodlife Drug Store in Kenya. Goodlife, a regional chain of pharmacies, grew from 6 to 19 stores under its first personal equity owner, then to 60 stores under its second owner.

” This is the future of health care, in resource-constrained environments, not just for Africa however for emerging and developed markets too,” Kuper stated. Fintech is one sector with both enormous impact capacity and where impact investors ought to continue with caution. In Kenya, for instance, an expansion of alternative credit-scoring services are offering newbie debtors with near-instant access to mobile credit at the exact same time use of gambling apps is skyrocketing amongst people who have protected quick and easy digital credit.

Goodwell and other investors in 2015 worked together via the Responsible Finance Online Forum on Guidelines for Responsible Purchasing Digital Financial Services. partner tivis capital. “If services aren’t being used in an accountable way, they can actually perpetuate monetary exemption.” Pressure to deploy ever-larger volumes of capital, combined with questionable due diligence practices and minimal to no regional existence or know-how create the conditions for a correction or market shakeout.

” It’s a situation we have actually seen in emerging markets investing before (grant carter). There will be some train smashes in the next few years.”.

open share links close share links Last month, leaders at a few of the world’s biggest companies took the noteworthy step of redefining the purpose of a corporation, adopting a “modern-day standard” for business responsibility that promotes “an economy that serves all Americans.” The 181 CEOs who signed the declaration from Business Roundtable, an association of ceo headed by JPMorgan Chase’s Jamie Dimon, pledged to run their companies “for the advantage of all stakeholders clients, workers, suppliers, communities, and shareholders.” The statement marks a significant relocation away from the adherence to investor primacy the belief that corporations exist primarily to serve shareholders which the group had accepted given that a minimum of 1997 – grant carter obtained.

Tyler Tysdal Business

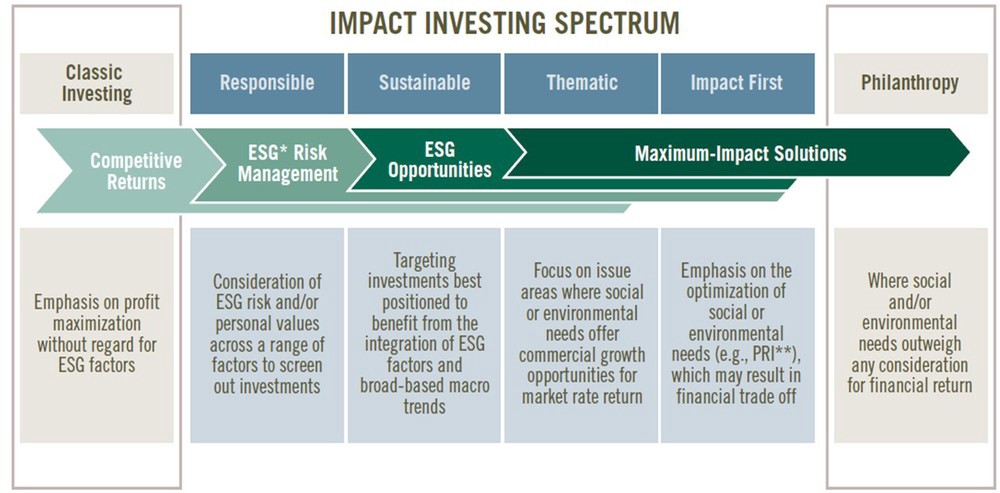

That pivot need to capture the eye of a growing number of organizations devoted to impact investing, the practice of investing in companies, organizations, and funds with the intention of generating not simply financial returns, but quantifiable social and ecological impact too (Tysdal carter johns creek). Underlying that philosophy is the belief that personal capital is vital to tackling the world’s most pressing environmental, social, and governance (ESG) issues, a principles echoed in business Roundtable statement of purpose, which stated, “We think the free-market system is the very best ways of producing excellent tasks, a strong and sustainable economy, innovation, a healthy environment, and financial chance for all.” That dovetails with views shared at an impact investing panel held previously this year, part of the 2019 MIT Sloan Investment Conference.

” The objective is to invest in product or services that serve a requirement, address genuine obstacles, and also can and should have to be rewarding.” We’re concentrating on the impact that investing has beyond monetary return. In addition, you’re wanting to generate an environmental or other impact. MIT Sloan financing “Impact investing is values-driven finance you designate capital to line up with the world you desire to see,” stated Amrita Sankar, MBA ’20, co-president of the MIT Impact Investing Initiative.

We see impact investing as an opportunity to use markets to correct for these sort of problems by supplying favorable social and environmental returns.” For all its appeal, the principle can be tough to pin down the expression “impact investing” itself is uncertain, said Gita Rao, a member of the MIT Sloan finance professors who teaches a class on social impact investing.

” That’s why my course is titled ‘Social Impact Investing,’ because we’re focusing on the impact that investing has beyond financial return. In addition to financial return, you’re hoping to produce an environmental or other impact.” The idea of investing with intention beyond financial return isn’t brand-new, Rao stated. “Faith-based organizations have been buying accordance with their worths for a really long time,” she pointed out.